Category: Exchange Traded Funds

61 posts categorized as "Exchange Traded Funds"

What makes us an ETF Specialist?

February 27, 2014

Content provided by Paula Wieck, CLS Portfolio Manager CLS is an investment firm that specializes in ETFs. So, why do we consider ourselves specialists? Did you know that we analyze over 200 data points on over 1,200 ETFs on a daily basis? That’s about a quarter of a million statistics which aid us in the investment…

New Active Methodology

February 14, 2014

Q: What is CLS’s active methodology? Pure, focused, global portfolios dedicated to a particular asset class segment, risk, or theme. These portfolios are concentrated; they will take active tilts relative to their benchmarks, and likely have higher turnover than our conventional Risk-Budgeted portfolios over time. Q: What are the differences between the active strategies and…

New Strategic Methodology Q&A

February 13, 2014

Q: What is CLS’s strategic methodology? In short, we emphasize high quality stocks and bonds. High quality stocks are those companies that tend to have higher profitability, stronger balance sheets, and higher dividend growth. High quality bonds meanwhile, are essentially Treasury bonds, including Treasury Inflation-Protected Securities (TIPS). Once the portfolio is established, we will not…

New Strategies: Q&A

February 11, 2014

Q: CLS has developed 10 new strategies, what was the driving force behind the expansion? When you walk into our building, the first thing you see on the wall is the saying “We empower investment advisors.” In short, these new strategies will help us reach out and empower more advisors to help more investors. One…

Top and Bottom ETFs

January 27, 2014

Content provided by Rui Wang, CLS Research Analyst 2013 was a great year for equity market in general, with the price return of the S&P 500 up 29 percent and the Russell 2000 up 36 percent. However, the MSCI ACWI ex-US index only rose 12 percent. Compared to the broad market indices, there was a…

Factor Investing

December 12, 2013

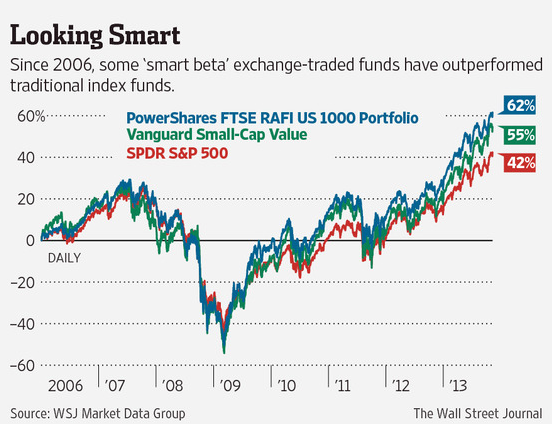

Content provided by Sierra Morris, CLS Junior Investment Research Analyst Smart beta has gotten a lot of press lately. This branding isn’t as intuitive as we would like, so CLS has decided to take a different spin on the name and call it “factor investing.” As an added bonus, by changing our labeling we won’t…

Statistics About ETF’s Show Exploding Growth

October 24, 2013

Content provided by Josh Jenkins, CLS Investment Research Analyst The universe of exchange traded products has experienced explosive growth over the last decade, and its continuing to grow. As of the end of September there are now 1,509 exchange-traded products (ETP): 1,302 ETF’s and 207 ETN’s. During the month there were six new ETPs that…

Missed the Cut

August 23, 2013

Content provided by Grant Engelbart, CLS Research/Portfolio Analyst In the ETF world, there is a constant barrage of new ETFs being issued and companies filing for new ETFs with the SEC. What’s often ignored is there are also a number of ETFs that close down each year. There are a number of reasons an ETF…

ETF Duress

July 9, 2013

Content provided by Grant Engelbart, CLS Research/Portfolio Analyst With the recent volatility in fixed income and emerging markets, ETFs have come under the microscope for being less-than-perfect investment vehicles. The Financial Times (FT) published an article on June 20 that ruffled some feathers among those in the ETF industry, to say the least. Let’s briefly…

MEOW: Pet Spending Continues to Rise

April 16, 2013

Content provided by Steve Donahoe, CLS Senior Portfolio Manager One of my favorite sayings is to “never underestimate the propensity of the U.S. consumer to spend money.” Along that line, I found this interesting: Americans spent an estimated $53 billion on their pets in 2012, a number that’s grown nearly 30% in the past five…