Category: Inflation

8 posts categorized as "Inflation"

Cumulative Returns and the Power of Compounding

September 10, 2019

By Kostya Etus, CFA, Senior Portfolio Manager In performance reports, time periods over one year are often annualized. Annualized returns may seem small, but compounded over a long period, they result in significant cumulative returns. As returns get higher and the time period stretches, small differences begin to have a more exponential impact. But it…

The Bright Side of Rising Rates

January 20, 2017

Content provided by Grant Engelbart, CFA, CAIA, CLS Portfolio Manager Investors have been infatuated with the timing and pace of the Federal Reserve’s (Fed’s) plan to raise interest rates ever since rates were pinned at the zero bound in the midst of the financial crisis. Most of the rhetoric regarding interest rate hikes is negative,…

The September FOMC Meeting

September 20, 2016

Content provided by Josh Jenkins, CFA, CLS Portfolio Manager Why a Hike Here Should Not Matter to Long-Term Investors The financial media has been focused on whether or not the Federal Open Market Committee (FOMC) will move to increase interest rates this week. Does this mean that long term investors should also take notice? Does…

Inside Capstone: Rising Interest Rates

August 24, 2016

Capstone’s Director of Fixed Income Investments and Portfolio Manager, Victoria Fernandez talks with CLS’s Portfolio Manager, Josh Jenkins, CFA, about whether or not investors should be concerned with the rising interest rates.

Likelihood of Interest Rate Hikes and Their Effect on Your Portfolio

December 15, 2015

Content provided by Josh Jenkins, CFA, CLS Portfolio Manager Recent guidance from the Federal Reserve (Fed) suggests it may finally be ready to lift interest rates at its next meeting on December 16, and the market has taken note. According to Bloomberg, as of December 10 the probability of a hike was 80%. Bloomberg has…

Oil is Down, Why Aren’t Gas Prices?

August 20, 2015

Content provided by Case Eichenberger, CLS Client Portfolio Manager Energy and oil funds have been volatile this year (to say the least), a trend that’s continued since the second half of 2014. Take a look at the chart below from January 9, 2015 to August 19, 2015, and you’ll see some bumpy rides for investors…

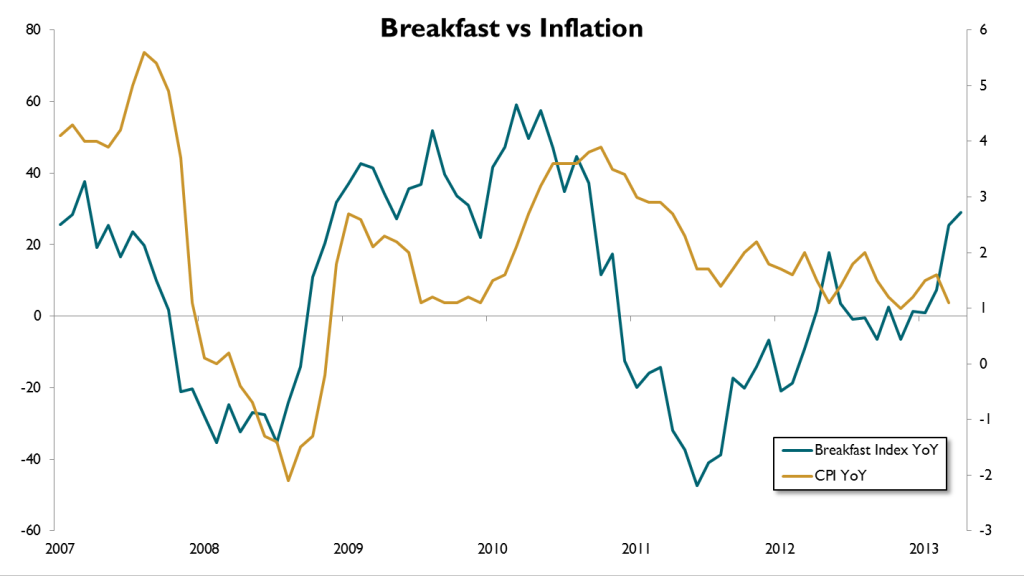

What’s for Breakfast?

April 9, 2014

Content provided by Grant Engelbart, CLS Portfolio Manager One of the most followed indices in all of finance is the Breakfast Index, created by Hard Assets Investor (HAI). I’m kidding of course, but yes, that is a real index. The breakfast index is an equally-weighted basket of the commodities listed below. Some are actively traded,…

Inflation and the Stock Market

March 4, 2014

Content provided by Sierra Morris, CLS Investment Analyst Recently, I read a report from Crestmont Research that looked into the effects of inflation on the stock market. It stated that, contrary to popular belief, it is inflation, not interest rates, that tend to drive P/E ratios. Crestmont reported that both rising inflation and deflationary environments…